Introduction to Adaptive Claims Management

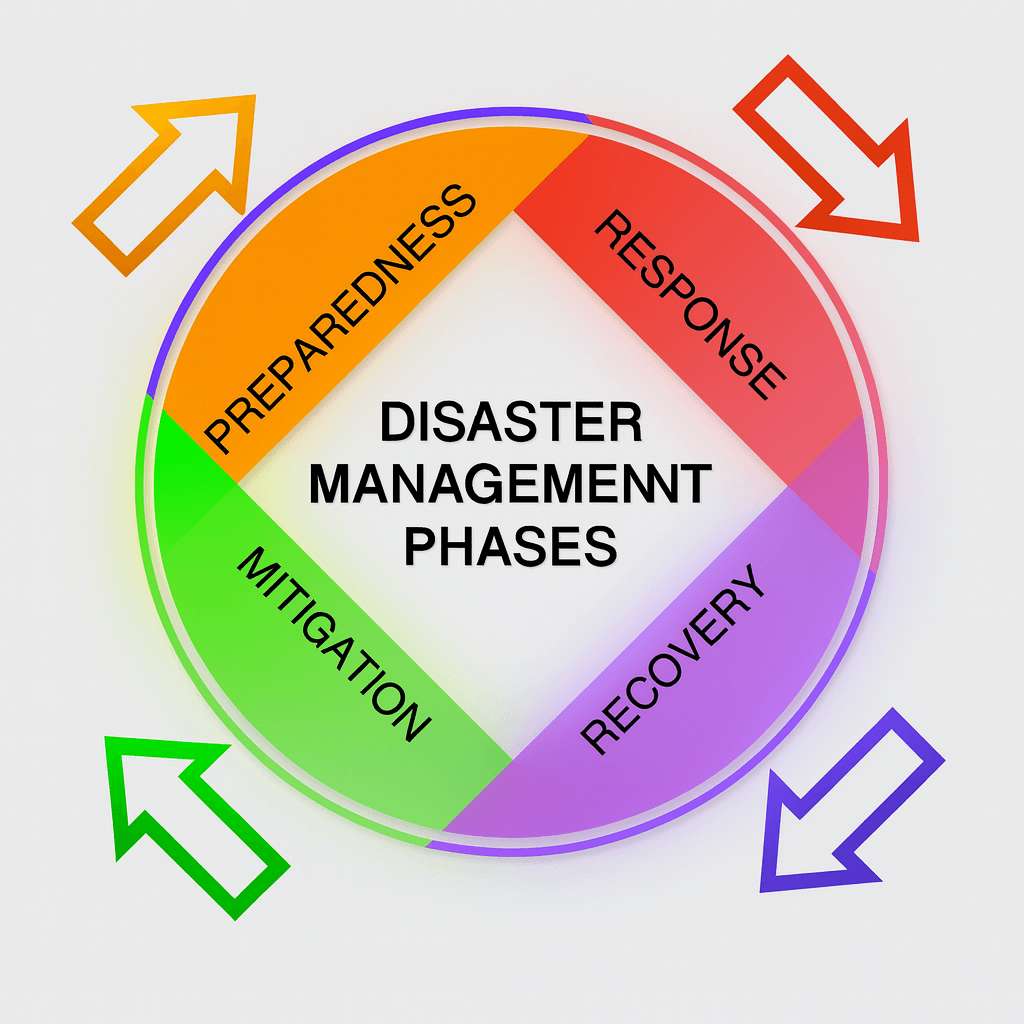

Natural disasters strike without warning. Victims often face financial and emotional loss at once. Adaptive Claims Management for Natural Disaster Victims offers a way to handle the rising number of claims faster and more fairly. By using technology and analytics, insurance providers can improve accuracy, reduce errors, and offer quicker help to people in need. This approach also creates more transparency and trust between victims and providers. It shifts the focus from paperwork to real support for disaster victims.

In the past, claims processes were slow and paper heavy. Modern adaptive systems streamline these steps. They verify details, assess damage, and provide automated updates. This makes the experience less stressful for victims. It also helps agencies allocate resources more efficiently. When claims move faster, recovery begins sooner. This type of system is vital in regions facing storms, floods, wildfires, and earthquakes.

The shift toward digital processes mirrors other industries embracing analytics. It allows for better decision making. It also lets organizations plan future relief efforts more effectively. Adaptive claims management creates a framework for stability after chaos.

Technology Integration in Disaster Recovery Support

Technology integration drives the backbone of modern claims management. Platforms now combine machine learning, predictive modeling, and secure databases to process large volumes of claims at once. This helps reduce bottlenecks and allows victims to access funds faster. When systems connect across agencies, information flows smoothly from first responders to insurance adjusters.

Mobile apps and online portals also help victims upload documents, photos, and videos of damage in real time. This gives claims teams a complete picture of the loss. It improves the accuracy of assessments and reduces disputes. Cloud storage adds security while keeping data accessible across teams. Automated risk scoring can highlight the most urgent cases and push them to the top of the queue.

With technology integration, disaster victims get more personalized support. Adjusters can see case history, location data, and risk level instantly. This leads to better decisions and higher client satisfaction. It also reduces the chance of fraud, which can drain resources meant for genuine claims. In effect, technology integration becomes a force multiplier in recovery support.

How Can Adaptive Claims Management Improve Client Satisfaction

Client satisfaction becomes the most important measure after a disaster. People need assurance that their claims are handled with empathy and speed. Adaptive systems provide real time updates, text alerts, and clear timelines. Victims no longer wait in the dark for progress reports. Transparency creates trust.

When analytics highlight common pain points, teams can adjust processes quickly. For example, if a system flags repeated delays in document verification, leaders can add more staff or improve automation at that step. This agile approach turns feedback into action. It also ensures that policies evolve with changing risks, such as more severe weather patterns.

Clear communication and simple forms reduce stress for victims. When people can check the status of their claim on their phone, they feel empowered. They can also make better decisions about temporary housing, repairs, or relocation. This sense of control enhances recovery support and aligns with the public’s expectation for fast digital services.

Training for Adaptive Claims Teams

Training plays a key role in making these systems effective. Staff must learn not only the technical side but also how to use empathy and cultural sensitivity during recovery. Short training modules can teach staff to navigate dashboards, interpret predictive scores, and explain data results in plain language to victims.

With ongoing training, claims teams improve accuracy and reduce processing time. They also learn how to identify patterns of fraud or high risk cases. This improves the safety and fairness of the claims system. Staff trained in data analytics can also design better reports for leadership, showing the impact of each disaster on claims volume and cost.

Training can extend to partner organizations such as relief agencies and local governments. This builds a stronger ecosystem of support. By sharing best practices, stakeholders work toward faster disaster recovery and better outcomes for affected communities. Effective training strengthens the connection between technology and human care.

Services and Support for Natural Disaster Victims

Services tailored to disaster victims go beyond simple claims processing. They include counseling, relocation assistance, and emergency housing. Adaptive platforms can match victims with the right support at the right time. For example, a family whose home has been completely destroyed may need faster access to funds and temporary shelter than someone with minor damage.

When services connect to predictive analytics, they can anticipate needs rather than react. This proactive approach helps victims feel secure even before their claim is fully resolved. It also allows insurers and governments to plan resource distribution more efficiently.

Integrating services into a single platform also improves accountability. Victims can track which agency is responsible for each part of their recovery support. This transparency reduces frustration and duplication. It aligns with broader efforts to modernize public services and provide more responsive care after a crisis.

Building a Future Ready Claims System

Communities facing storms, fires, or floods need more than a check. They need a reliable system that acts as a lifeline. By adopting Adaptive Claims Management for Natural Disaster Victims, agencies and insurers can deliver faster aid, improve transparency, and help families rebuild sooner. PNCAi and similar platforms showcase how technology, analytics, and training combine to serve people at their most vulnerable moments.

If your organization handles claims for disaster victims, now is the time to act. Investing in technology integration, staff training, and enhanced services creates resilience. It strengthens public trust and sets a standard for ethical and efficient claims handling.

External Link for reference and research: https://www.fema.gov

Discover how your team can transform claims processes, support victims better, and reduce delays with adaptive solutions. Partner with experts in analytics, client satisfaction, and recovery support to build a system ready for the next disaster. Begin shaping a new era of compassionate claims management today.